The Ultimate Guide to BaoXing Bags

Explore the latest trends and styles in BaoXing bags.

Term Life Insurance: Your Unexpected Secret Weapon

Unlock the hidden power of term life insurance—your ultimate secret weapon for financial security and peace of mind! Discover how today!

Understanding Term Life Insurance: Is It Right for You?

Term life insurance is a type of life insurance policy that provides coverage for a specific period, usually ranging from 10 to 30 years. Unlike whole life insurance, which offers lifetime coverage and accumulates cash value, term life is designed to offer financial protection for a limited time. This makes it an appealing option for individuals who want to ensure their loved ones are financially secure during critical years, such as when raising children or paying off a mortgage. If you're considering term life insurance, it's essential to assess your financial obligations and the needs of your dependents to determine the appropriate amount and length of coverage.

One of the primary benefits of term life insurance is its affordability. Monthly premiums are generally lower than those of permanent life insurance policies. Before deciding if this type of coverage is right for you, consider factors such as your current health, age, and financial goals. If your needs change over time or if you find that you require a longer-term solution for ongoing financial obligations, there are options available, including renewing or converting your policy. Ultimately, understanding term life insurance can help you make informed decisions that align with your financial priorities and protect your loved ones' future.

5 Surprising Benefits of Term Life Insurance You Didn't Know About

When many people think of term life insurance, they primarily focus on its ability to provide financial security for loved ones in the event of an untimely passing. However, term life insurance offers a range of surprising benefits that go beyond its traditional role. Here are five unexpected advantages:

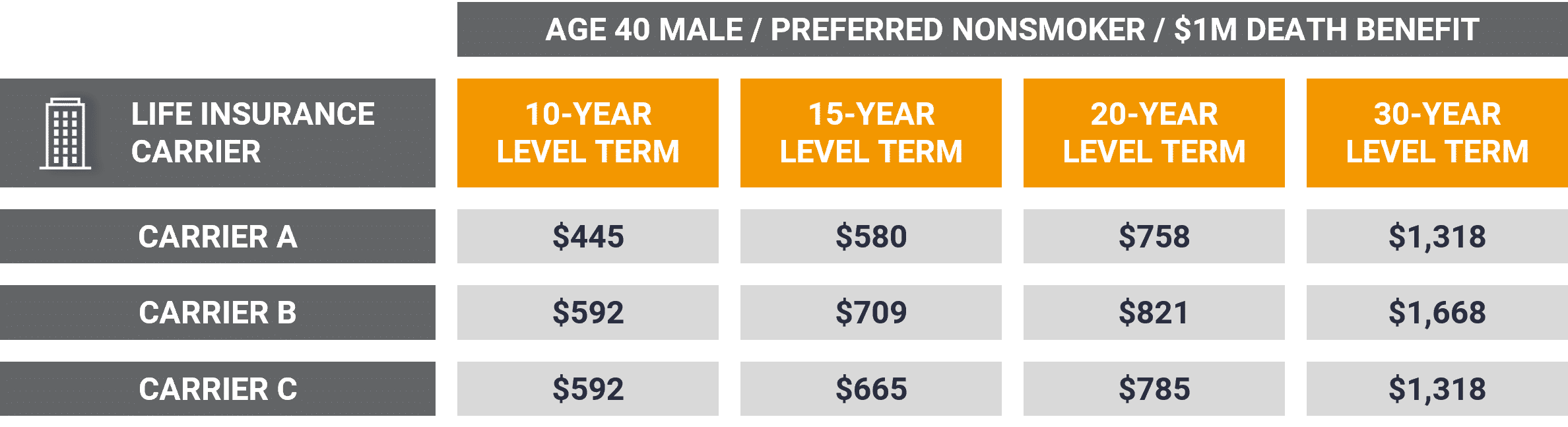

- Affordability: Term life insurance policies are typically more budget-friendly compared to whole life insurance, allowing you to obtain a high level of coverage at a lower premium.

- Flexibility: With various term lengths available, you can choose a policy that aligns with your specific needs, whether it’s covering a mortgage or protecting children's education expenses.

Additionally, term life insurance can serve as a valuable financial tool. Consider these lesser-known benefits:

- Peace of Mind: Knowing that your dependent’s future is financially secure can alleviate stress, allowing you to focus on other aspects of life.

- Investment Opportunities: The lower premium costs can free up funds to invest elsewhere, potentially yielding better returns.

- Convertibility: Many term life policies allow you to convert to a permanent policy without a medical exam, ensuring you still have coverage as your needs change.

How Term Life Insurance Can Be Your Financial Safety Net

Term life insurance serves as a critical financial safety net, providing peace of mind and financial security for your loved ones in case of unforeseen circumstances. With a fixed premium for a specified period, typically 10, 20, or 30 years, it ensures that your beneficiaries receive a death benefit that can help cover essential expenses such as mortgage payments, education costs, and daily living expenses. The affordability of term life insurance makes it an attractive option for young families and individuals seeking to protect their financial future without breaking the bank.

Moreover, term life insurance can function as a strategic part of your overall financial plan. By locking in a policy while you are young and healthy, you can secure lower premiums and greater coverage amounts. During the term, the death benefit can act as a buffer against debts and financial obligations, ultimately allowing you to build savings and investments without the constant worry of what might happen should the unexpected occur. Thus, ensuring that your loved ones are taken care of can alleviate stress and foster a secure financial foundation.