The Ultimate Guide to BaoXing Bags

Explore the latest trends and styles in BaoXing bags.

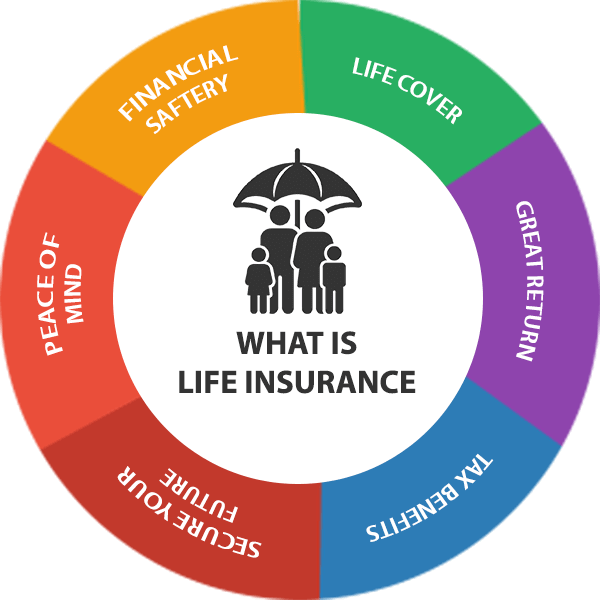

Life Insurance: Your Safety Net or a Hole in Your Pocket?

Is life insurance your ultimate safety net or just an expensive burden? Discover the truth that could save your financial future!

Is Life Insurance Worth the Investment?

When considering whether life insurance is worth the investment, it's essential to evaluate the financial security it provides to your loved ones. In the event of an untimely death, life insurance benefits can cover outstanding debts, mortgage payments, and everyday living expenses, ensuring that your family's lifestyle isn't drastically impacted. The peace of mind that comes from knowing your family will be taken care of financially if something were to happen to you can be invaluable.

Moreover, life insurance can play a strategic role in long-term financial planning. Many policies accumulate cash value over time, which can be borrowed against or withdrawn if necessary. This can serve as a financial asset during retirement or in emergencies. Ultimately, while the cost of premiums may seem like a burden now, the potential benefits in terms of financial security and peace of mind often outweigh the initial investment.

Understanding the Different Types of Life Insurance Policies

When it comes to financial planning, understanding the different types of life insurance policies is crucial. Each policy serves a unique purpose and caters to various personal and financial needs. The main types of life insurance include term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an ideal choice for those seeking affordable premiums while securing financial protection for their loved ones during critical years. In contrast, whole life insurance offers lifelong coverage along with a savings component, allowing the policyholder to accumulate cash value over time.

Another important type is universal life insurance, which combines the benefits of both term and whole life policies. This flexible policy enables policyholders to adjust their premiums and death benefits as their financial situation evolves. Understanding these differences is essential for selecting the right policy that aligns with your financial goals and family needs. By doing thorough research and consulting with an insurance professional, you can make an informed decision that ensures your loved ones are protected financially in the event of unexpected circumstances.

How to Choose the Right Life Insurance Coverage for Your Needs

Choosing the right life insurance coverage is crucial for ensuring financial security for your loved ones. Begin by assessing your personal circumstances, including your income, debts, and long-term financial goals. A good starting point is to calculate your coverage needs by considering factors such as your family’s living expenses, outstanding loans, and future obligations like college tuition. You might find it helpful to use a formula, where you multiply your annual income by a factor of 10 to 15. This gives you a ballpark figure of how much coverage might be necessary.

Next, you should familiarize yourself with the different types of life insurance policies available. Generally, you can choose between term life insurance, which provides coverage for a specific period, and whole life insurance, which offers coverage for your entire life. Each type has its pros and cons, so consider your financial situation and what you hope to achieve with your policy. Additionally, it can be beneficial to consult with a financial advisor or an insurance agent to ensure that your choice aligns with your overall financial strategy.