The Ultimate Guide to BaoXing Bags

Explore the latest trends and styles in BaoXing bags.

Whole Life Insurance: The Policy That Keeps on Giving

Discover why Whole Life Insurance is the ultimate financial gift that keeps on giving—security, savings, and peace of mind await!

What is Whole Life Insurance and How Does It Work?

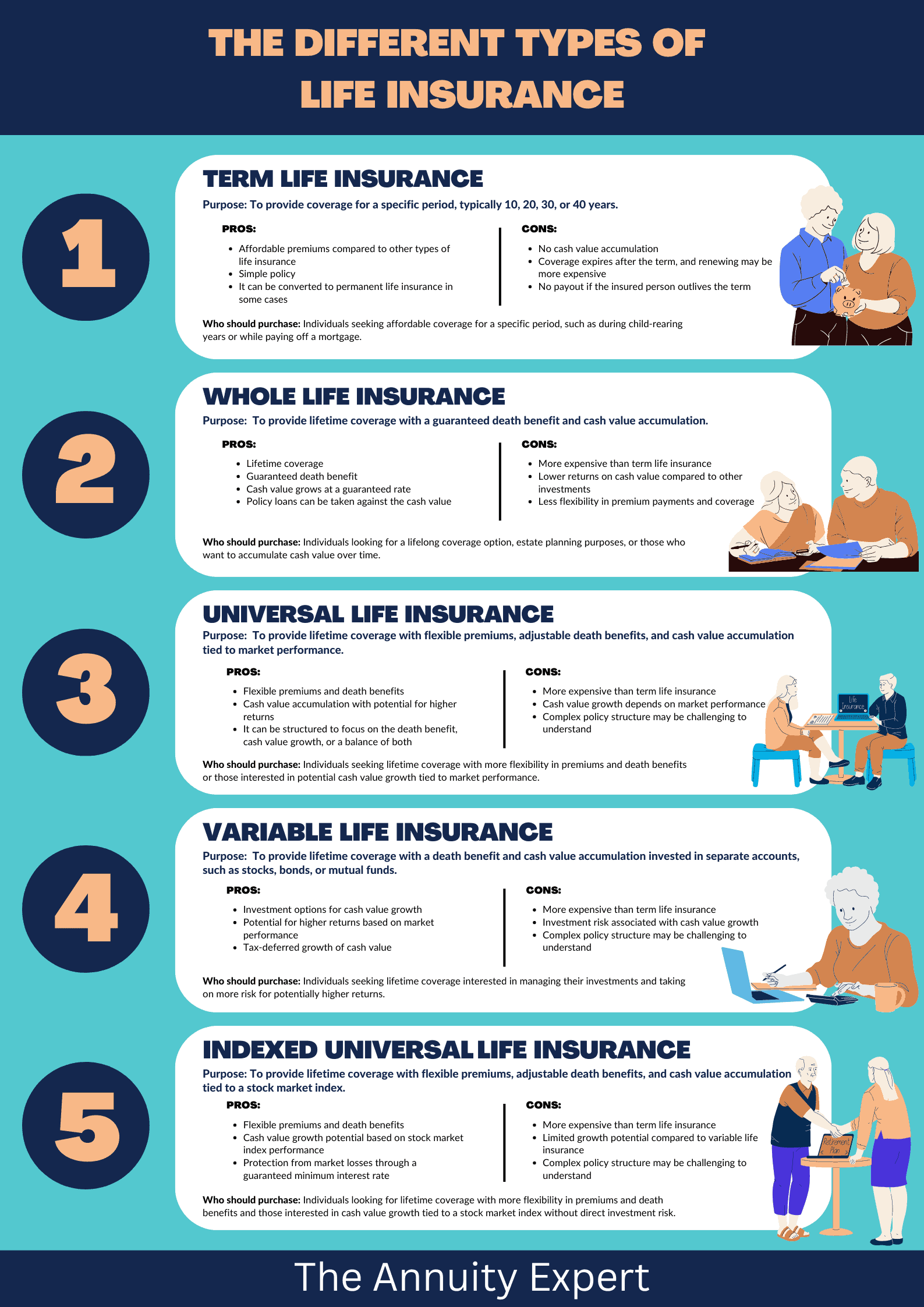

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire lifetime, as long as the premiums are paid. Unlike term life insurance, which offers protection for a specific period, whole life insurance accumulates cash value over time. This cash value can be accessed by the policyholder during their lifetime, providing a potential source of funds in emergencies or opportunities. The premiums for whole life insurance are generally higher than those for term insurance, but they remain fixed throughout the life of the policy, offering predictability and stability.

When you purchase a whole life insurance policy, a portion of your premium goes toward the death benefit, while another portion contributes to the cash value of the policy. This cash value grows at a guaranteed rate, and policyholders can borrow against it or even withdraw funds, although doing so may reduce the death benefit. It's essential to understand the terms of your policy, including any fees or implications of taking loans against the cash value. In summary, whole life insurance combines lifelong protection with a savings component, making it a comprehensive financial planning tool.

Top 5 Benefits of Whole Life Insurance for Your Financial Future

Whole life insurance is a unique financial product that not only provides a death benefit but also acts as a long-term savings strategy. One of its primary benefits is the guaranteed cash value accumulation. Over time, as you pay your premiums, your policy builds cash value that can be accessed during your lifetime for emergencies or opportunities, making it a versatile asset in your financial portfolio.

Additionally, whole life insurance offers premiums that remain level throughout your life, providing peace of mind against rising costs. This predictability makes it easier to plan your budget and allocate your finances effectively. Moreover, the death benefit is typically tax-free to your beneficiaries, ensuring that your loved ones are financially secure when the time comes. Overall, the integration of these features makes whole life insurance a reliable choice for securing your financial future.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whole life insurance, it's essential to evaluate your individual financial situation and long-term goals. Ask yourself, what are my primary reasons for seeking insurance? Are you looking for a way to provide financial security for your loved ones, accumulate cash value over time, or perhaps even leave a legacy? Understanding the core purpose of your policy can significantly influence your decision-making process.

Additionally, consider the cost of whole life insurance compared to other types of coverage. Whole life premiums are typically higher than term life premiums, but they offer benefits like guaranteed death benefits and cash value accumulation. To make an informed choice, think about these key questions:

- Can I afford the premium payments long-term?

- Do I need lifelong coverage, or would a term policy suffice?

- Am I looking for an investment component in my insurance?