The Ultimate Guide to BaoXing Bags

Explore the latest trends and styles in BaoXing bags.

Crypto Regulation Updates: Don’t Get Caught Off Guard Again

Stay ahead in the crypto game! Discover essential regulation updates to protect your investments and avoid costly pitfalls. Don't miss out!

Understanding the Latest Cryptocurrency Regulations: Key Changes You Need to Know

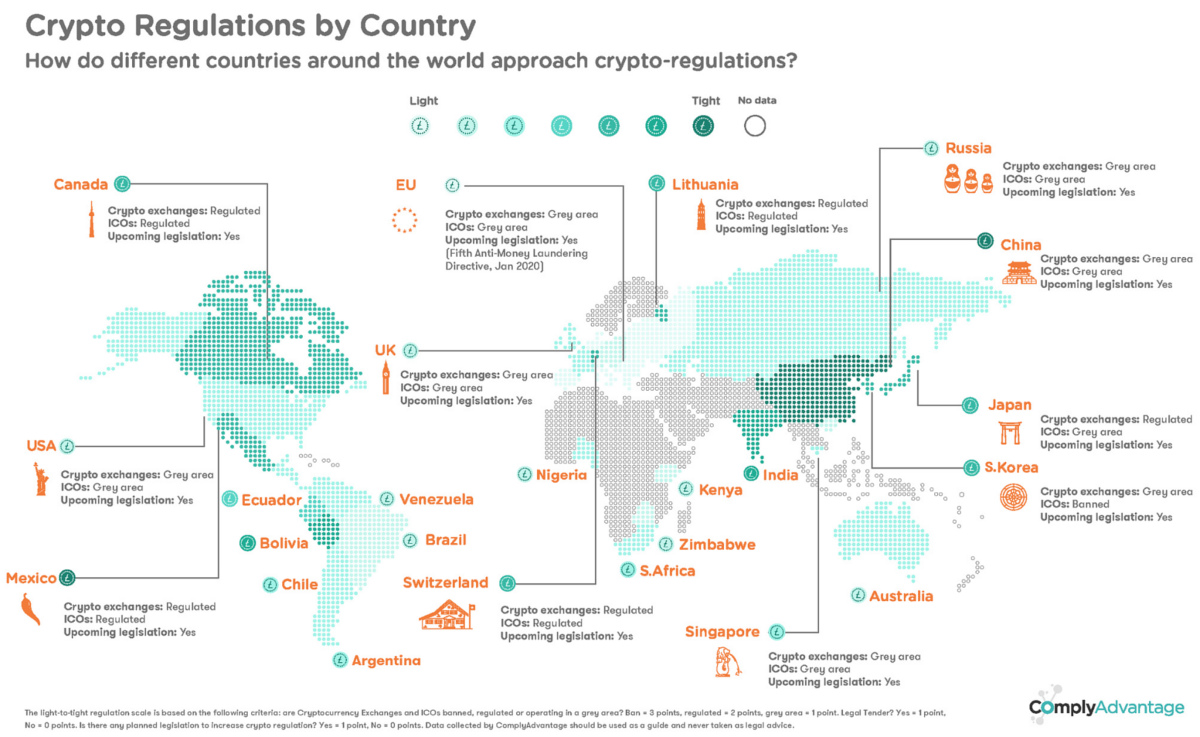

The landscape of cryptocurrency regulations is rapidly evolving, and understanding the latest changes is crucial for investors and enthusiasts alike. Key regulations introduced globally have been designed to enhance transparency, prevent fraud, and protect consumers. For instance, the Financial Action Task Force (FATF) has implemented guidelines that require cryptocurrency exchanges to verify users' identities, effectively adding a layer of compliance that aligns with traditional financial systems.

Additionally, countries like the United States and European Union are introducing legislation aimed at boosting market integrity and ensuring fair practices. Some key changes include stricter reporting requirements for tax purposes and registration mandates for exchanges. It’s essential for anyone involved in cryptocurrency to stay updated on these regulations not only to avoid potential legal issues but also to maximize their investment strategies.

Counter-Strike is a highly popular team-based first-person shooter that has captivated gamers around the world. Players compete in various game modes, often focusing on a terrorist versus counter-terrorist scenario. For those looking to add an extra layer of excitement to their gameplay, using a betpanda promo code can enhance their betting experience on match outcomes.

How New Crypto Laws Impact Your Investments: A Comprehensive Guide

The rapidly evolving landscape of cryptocurrencies is significantly shaped by new regulations and laws that can profoundly impact your investment strategies. Understanding how new crypto laws affect the market is crucial for both new and seasoned investors. As governments worldwide strive to establish frameworks that ensure consumer protection and combat illicit activities, these regulations often influence market volatility and overall investment risk. For instance, countries implementing strict tax compliance measures or stringent licensing requirements may deter some investors, potentially leading to fluctuations in market prices.

One major area where new crypto laws can have a substantial impact is in the realm of exchange operations. Regulatory bodies are increasingly mandating that cryptocurrency exchanges adhere to know-your-customer (KYC) and anti-money laundering (AML) protocols. This can create a more secure trading environment for investors but may also limit access for individuals in jurisdictions with strict compliance costs. Keeping an eye on upcoming regulations and understanding their implications is essential. Here are a few key factors you should consider:

- Taxation changes affecting crypto gains

- Increased scrutiny of exchanges and wallets

- New guidelines for Initial Coin Offerings (ICOs)

What Should You Expect from Future Crypto Regulations? Expert Insights and Predictions

The landscape of cryptocurrency regulation is rapidly evolving, and what can we expect from future crypto regulations? Experts suggest a trend towards more structured oversight, aiming to enhance consumer protection while fostering innovation. In many jurisdictions, including the EU and the US, regulatory bodies are prioritizing frameworks that will ensure compliance without stifling the growth of digital assets. Key areas of focus will likely include anti-money laundering (AML) measures, taxation policies, and KYC (Know Your Customer) regulations, all designed to create a safer trading environment.

Moreover, as crypto regulations become more standardized worldwide, we might witness a shift towards greater collaboration between international regulatory agencies. Analysts predict an increase in cross-border regulatory frameworks that align various nations' approaches to digital currencies. This will not only facilitate smoother transactions but also help prevent fraudulent activities across borders. As we look towards the future, investors and businesses should prepare for a landscape that is more defined, with regulatory clarity ultimately paving the way for greater mainstream adoption of cryptocurrencies.