The Ultimate Guide to BaoXing Bags

Explore the latest trends and styles in BaoXing bags.

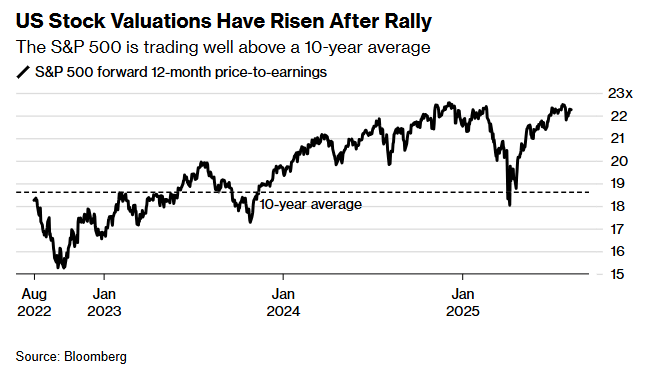

Falling Markets, Rising Potential: Reevaluating Valuations Post-Drop

Discover how falling markets can unveil hidden opportunities. Unlock insights on reevaluating valuations and seizing potential growth.

Understanding Market Corrections: How to Spot Opportunities in Falling Valuations

Understanding market corrections is essential for investors looking to navigate the inevitable fluctuations in the financial landscape. A market correction typically refers to a decline of 10% or more in the price of an asset, signaling a potential shift in investor sentiment. While falling valuations can seem alarming, these periods often present lucrative investment opportunities. By recognizing the signs of a market correction, such as heightened volatility or economic downturns, savvy investors can position themselves to capitalize on undervalued assets in the recovery phase.

To effectively spot opportunities during market corrections, consider leveraging several analytical strategies. Firstly, perform a thorough analysis of market trends and historical performance to identify stocks that have consistently rebounded post-correction. Secondly, keep an eye on strong fundamentals, such as revenue growth and profit margins, which can be indicators of long-term stability. Finally, utilize technical analysis to pinpoint entry and exit points, maximizing potential gains. By adopting these tactics, investors can turn periods of turmoil into rewarding opportunities for growth and profit.

Counter-Strike, a popular tactical first-person shooter, has evolved through several iterations since its inception. Players engage in team-based combat, with each match typically revolving around objectives such as bomb defusal or hostage rescue. Recently, the skin market recovery has garnered attention, affecting both the game's economy and players' experiences.

Is Now the Right Time to Invest? Evaluating Stocks After a Market Drop

When considering whether now is the right time to invest, particularly after a market drop, it’s crucial to evaluate the underlying factors driving the decline. Market corrections can be unnerving, but they also present unique opportunities for investors. Historical trends indicate that many stocks eventually rebound and provide long-term gains. Understanding the reasons behind a drop—such as economic indicators, geopolitical events, or company-specific issues—can help you make informed decisions. Always conduct thorough research and analyze market sentiment to gauge potential recovery.

Furthermore, it’s advisable to create a diversified portfolio to mitigate risk during volatile times. Investing in a mix of asset classes such as stocks, bonds, and commodities can help balance your exposure. Additionally, consider employing strategies like dollar-cost averaging, where you invest a fixed amount regularly, reducing the impact of market fluctuations. Remember to regularly review your investments and stay updated on market trends to seize advantageous opportunities when the market recovers.

Reassessing Risk: What Falling Markets Mean for Your Investment Strategy

Falling markets often evoke a sense of panic among investors, leading to rash decisions that can derail long-term strategies. However, it's essential to reassess risk and understand that downturns can present unique opportunities. During such periods, investors should consider recalibrating their portfolios by focusing on diversification and identifying undervalued assets. By adopting a disciplined approach, you can not only weather the storm but potentially enhance your returns when the market rebounds.

Moreover, it's crucial to remember that investment strategy should align with your long-term goals rather than short-term market fluctuations. An effective way to navigate falling markets is to implement a strategy of dollar-cost averaging, which allows you to invest consistently over time, reducing the impact of volatility. Additionally, reviewing your asset allocation can help ensure that your investments are still aligned with your risk tolerance. Ultimately, staying informed and adaptable is key to thriving in challenging market conditions.